> Industry & Business

Phosphate markets

In 2021, world supply of P-fertilisers achieved about 50Mt, one third of N-fertilisers (ammonia) volumes. 30 % of Russian exports of P-fertilisers went to the EU, for a value over 1 billion €. It is around 10 times lower than the value of EU imports of natural gas from Russia. It is said that all 165 000 tonnes of deflourinated feed phosphate (DFP) consumed in the USA come from the Russian region. Brazil, the world’s biggest soybean exporter, relies heavily on imported fertilisers from Russia and Belarus. These two countries represent more than 10 % of fertilisers imported to Thailand.

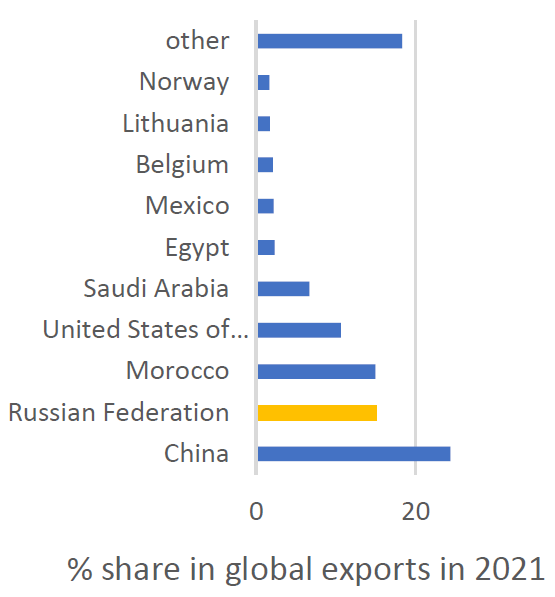

Top 10 exporters of P-fertilisers:

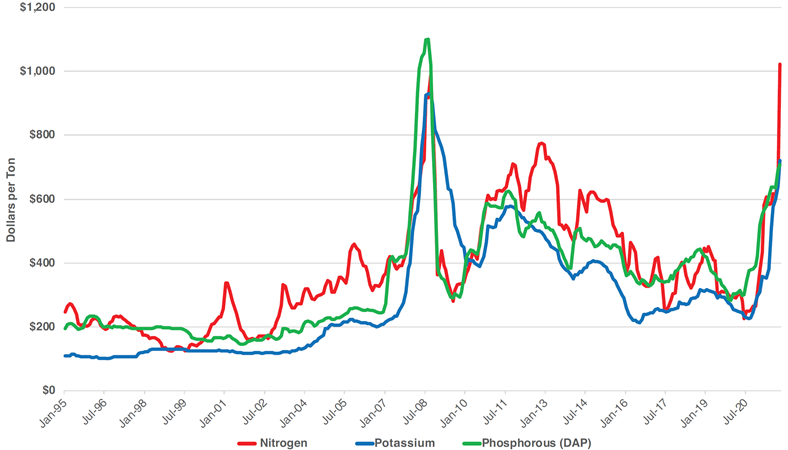

Phosphate prices were already escalating prior to the conflict in Ukraine, as a result of pandemic-related supply chain disruptions and transportation costs, political decisions, and higher costs of natural gas. Record natural gas and coal prices forced some fertiliser makers to cut output in that energy-hungry sector. USA imposed higher tariffs on some P imports, while China decided to freeze phosphate exports in Sept 2021. Ammonia and sulfur, two critical inputs in the manufacturing process, had seen prices in 2021 multiplied by 3 and 2, respectively.

Monthly fertiliser nutrient prices, Jan 1995 – Oct 2021 (USA)

The world market for feed-grade phosphates (3,5 Million t; est. USD 2.25 billion in 2018) represents only 7 % of volumes of fertiliser-grade phosphates (48 Mt). But in the EU, annual P consumption totals about 1,5Mt, with 2/3 consumed in fertilisers and 1/3 in animal feed. In 2021, Russia exported almost 400 000 tonnes of feed phosphate to the EU, with Estonia, Finland, Poland, and Germany being the top destinations.

Prices of phosphates, already high, are expected to rise further. Sanctions to the Russian financial system and to selected oligarchs working in P-fertilisers business, logistic or other factors will make trade difficult or impossible. At country, territory or company level, some decisions are taken in order to reduce the reliance on imported phosphates. Technologies and policies to value animal wastes (manure, litter) and biosolids are reinforced, while research on recycled P from biomass is intensified. Alternative feed ingredients such as DDGS are available in some areas. In China, new recommendations lowering P inclusion in animal feed favoured cost savings from using less feed phosphate and cheap phytase. JBS, the world’s largest poultry producer, just inaugurated a 24M USD manufacturing plant in Sao Paulo (Brasil) with a production capacity of 150 000 tons of fertilisers.